The Medicaid look-back period is a specific timeframe, typically 60 months (5 years) before the date you apply for Medicaid long-term care benefits. During this period, Medicaid reviews your financial transactions to ensure that you did not transfer assets for less than their fair market value to qualify for Medicaid.

Transfers that may be considered violations include:

Example 1: Gift to a Family Member

If you gift $20,000 to your child within the look-back period, this transfer could be deemed as an attempt to reduce your assets to qualify for Medicaid.

Example 2: Selling a House Below Market Value

If you sell your home to a friend for $50,000, but its market value is $100,000, Medicaid may consider the difference ($50,000) as an improper transfer.

Example 3: Placing Assets in a Trust

If you transfer $100,000 to an irrevocable trust within the look-back period, Medicaid may view this as an attempt to shield assets from being counted for eligibility.

If Medicaid finds that you have made improper transfers, it can result in a penalty period during which you will not be eligible for Medicaid benefits. This penalty period is calculated based on the amount of the improper transfer and can delay your eligibility for Medicaid coverage.

The penalty period is calculated using the following steps:

1. Determine the Amount of the Transfer: Calculate the total value of the transferred assets that were not returned or compensated

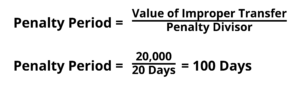

2. Divide by the State’s Penalty Divisor: Each state has a specific penalty divisor, which is the average cost of nursing home care in the state. For example, if the penalty divisor is $200 per day, and you made an improper transfer of $20,000, the penalty period would be calculated as follows:

3. Apply the Penalty Period: During this penalty period, you will not be eligible for Medicaid coverage. The penalty period starts on the date you would otherwise be eligible for Medicaid benefits.

Example Calculation

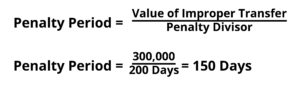

For example, if you transferred $30,000 and the penalty divisor is $200, your penalty period would be 150 days.

To avoid penalties, it’s crucial to plan ahead:

The Medicaid look-back period is a timeframe, typically 60 months (5 years), during which Medicaid reviews your financial transactions to ensure that you haven’t transferred assets for less than their fair market value to qualify for benefits. This period helps prevent individuals from giving away assets or selling them below market value to meet Medicaid’s financial eligibility requirements.

If Medicaid finds that you have transferred assets for less than their fair market value during the look-back period, you may face a penalty period during which you will not be eligible for Medicaid benefits. This penalty period is based on the amount of the improper transfer and can delay your eligibility for Medicaid long-term care coverage.

Transfers that may be deemed improper include:

The penalty is calculated by dividing the total value of the improper transfer by the state’s penalty divisor, which represents the average cost of long-term care in the state. For example, if you made an improper transfer of $30,000 and the penalty divisor is $200 per day, your penalty period would be calculated as follows:

During this penalty period, you will not be eligible for Medicaid benefits.

Transfers to a spouse or a disabled child may be exempt from the Medicaid look-back period penalties. However, it’s important to follow the specific rules and limits that apply to these transfers. For example, transferring assets to a spouse typically does not trigger a penalty but must be done within the guidelines set by Medicaid. Consult with a Medicaid planning expert to ensure compliance with all regulations and to understand how these transfers can impact eligibility.

Understanding the Medicaid look-back period is essential for effective Medicaid planning. By being aware of what constitutes improper transfers and how penalties are calculated, you can make informed decisions and avoid delays in receiving Medicaid benefits. Always consult with a Medicaid planning expert to navigate these rules and ensure compliance.