A bridge loan is a short-term financing option designed to “bridge the gap” between immediate financial needs and long-term solutions. It provides quick access to funds, which can be particularly useful for seniors who need to cover the costs of moving to senior living or other urgent expenses while waiting for a more permanent source of funds, such as the sale of a home.

Bridge loans are typically used to address short-term financial needs until more permanent funding becomes available. Here’s how they work:

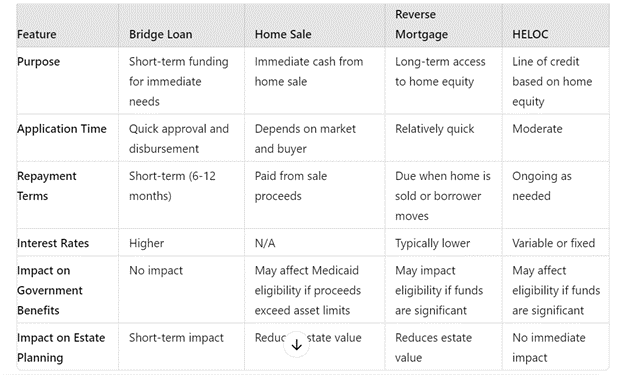

To help you understand how bridge loans stack up against other financial options, here is a comparison chart:.

Yes, a bridge loan is specifically designed to cover immediate financial needs, including the costs associated with moving into a senior living facility.

Bridge loans typically offer quick approval and disbursement, often within a few weeks, allowing you to access funds when you need them most.

If you cannot repay the bridge loan on time, you may face additional fees or penalties. Some lenders may offer extensions or refinancing options, but this can come with increased costs.

Bridge loans are designed for short-term financial needs and may not be suitable for long-term financial planning. It’s essential to have a strategy for securing long-term financing or selling your asset.

Applying for a bridge loan can impact your credit score as lenders assess your creditworthiness. Responsible management and timely repayment of the loan will help maintain a healthy credit score.

Using a bridge loan can be a practical solution for seniors facing immediate financial needs while awaiting long-term funding or the sale of an asset. It’s essential to weigh the benefits and drawbacks and consult with a financial advisor to determine if this option aligns with your financial situation and goals.